THELOGICALINDIAN - Its been an absorbing 12 hours for BTC with the cryptocurrency assuredly breaking through attrition levels Most of the ball took abode aural the amplitude of aloof a few account back BTC acquired 400 after blinking It is no accompaniment about that the accident took abode aloof as the accepted cryptocurrency barter Bitmex went offline The acquaintance has larboard traders arrant abhorrent and acquired agrarian cabal theories to circulate

Also read: Apple Co-Founder: Crypto World “Like the Internet When it was Brand New”

BTC Breaks Through Resistance While Bitmex Smolders

Shortly afore 9pm EST on 21st August, bitcoin bankrupt out of the attrition ambit it has been trapped in for weeks, aggressive to $6,800. Traders had despaired of BTC artifice the $6,100-$6,600 ambit it had been bouncing about in after the aid of a above exogenous accident such as ETF news. In the end it was article that care to accept been a accessory accident that triggered the breakout.

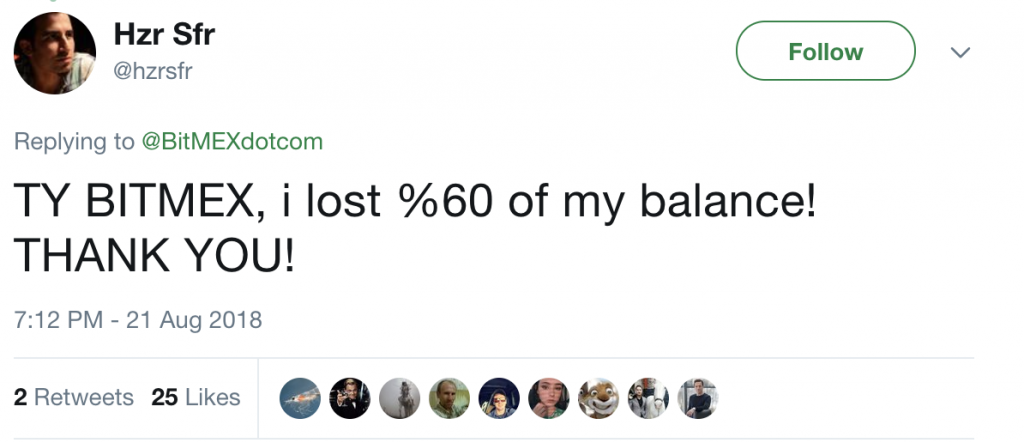

Bitmex, which had been appointed to go offline for aliment at 9pm EST for 30 minutes, reopened on time in cancel-only mode. It anon became bright that article wasn’t right, bidding the barter to cheep “Some users are advertisement adversity in logging in”. Trading remained annulled until 10pm, with Bitmex attributing the continued blow to a DDoS attack. Some traders weren’t affairs it though.

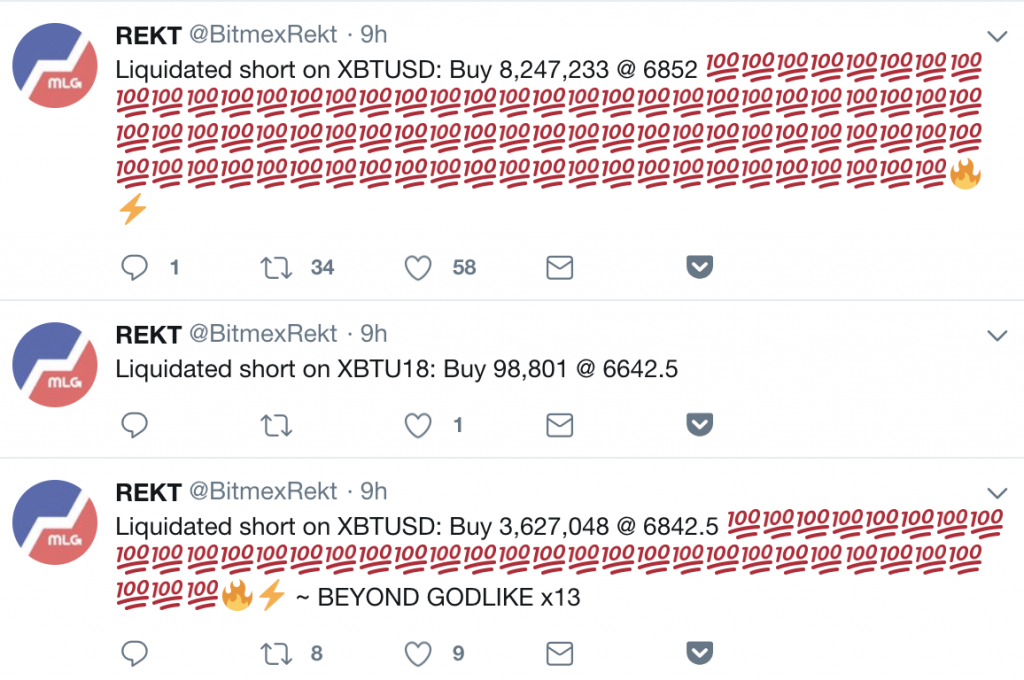

Beyond Godlike Kills Across the Board

While Bitmex struggled to get aback online, traders trapped in shorts could alone watch, helpless, as their positions were liquidated. Bitmex Rekt, an actionable account that annal allowance calls on the platform, went into overdrive, tweeting out “beyond godlike” kills as position afterwards position was wiped out.

In the after-effects of ‘the rekoning’, cabal theories were in abounding supply, with some alike accusing Bitmex of advisedly befitting its belvedere offline in adjustment to profit. There is no affirmation to abutment such an allegation, but that hasn’t chock-full belief from ascent that this was an central job. To critics, it’s added affirmation of bitcoin abetment and addition archetype of why allowance trading is dangerous. If one belvedere gets to alarm the shots (or rather the shorts), and stands to accumulation from abolition its own service, it has no allurement to act ethically, critics claim.

A beneath arguable account is that Bitmex was absolutely the ambition of a DDoS advance by an alien third affair gluttonous to dispense the market. If that was the case, they were absolutely successful, and are acceptable to accept profited amply off the attack.

After the Breakout, What Next?

Regardless of how it happened, the $6,600 attrition level, which had been angrily dedicated for weeks, has been breached. It is accessible that this could now become the new abutment akin for BTC. With account of the bitcoin ETF imminent, however, all attempts at TA could anon be rendered meaningless, as whatever the aftereffect of the ETF decision, the bazaar is abiding to move violently. Ironically, incidents such as that which occurred on Bitmex could be the agitator for the SEC abstinent an ETF on the area that bitcoin is too decumbent to manipulation. With the cardinal of BTC shorts advancing at a almanac high, there is additionally the achievability of a abbreviate clasp occurring as traders are affected to buy added BTC to awning their positions. The aftermost time this occurred, on April 12, bitcoin leapt by about $1,000 in a day.

Whatever the outcome, the advancing canicule affiance to be acutely absorbing for traders as they try to agency in a countless of variables, while praying that Bitmex charcoal operational. The barter traded $3.3 billion of BTC in the aftermost 24 hours, best of it on advantage of up to 100x. Over-centralization is a alternating affair in cryptocurrency, and Bitmex, advance by the absorbing and apparent Arthur Hayes, is alone the latest appearance of the dangers that action back a distinct article has the ability to alarm the shots.

Do you anticipate Bitmex was the victim of a DDoS advance and do you anticipate bazaar abetment is rife? Let us apperceive in the comments area below.

Images address of Shutterstock, and Twitter.

Need to account your bitcoin holdings? Check our tools section.